Is Croissant's 'buyback' fintech model the answer to BNPL?

US fintech platform Croissant is launching a new challenger to the buy-now-pay-later (BNPL) model after securing US$24m in seed funding from a range of investors, led by Portage and the founders of investment management firm KKR.

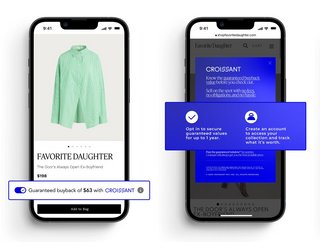

Croissant integrates directly into merchants’ existing checkout flows to give shoppers a guaranteed ‘buyback’ value at the point of sale, giving them the chance to sell the item back within a year if they wish. The buyback price is determined by an AI-powered algorithm, with Croissant then fulfilling those buyback guarantees.

As well as providing an alternative model to BNPL (Croissant says its own system was developed in response to debt-focused offerings), the company claims that buyback schemes help to improve conversion, customer retention and average order value. After a customer makes a purchase, the item will be visible in their Croissant account, from where they can accept the buyback offer at a time that suits them. Once a customer sells their item back to Croissant, they are funnelled back to the merchant with new funds in tow to buy themselves something new.

The model is clearly adaptable to industries with a reputation for ‘throwaway’ consumerism – such as fast fashion or the constant cycle of consumer tech. Indeed, according to the humanitarian charity Oxfam, we use 400% more clothing every year than we did two decades ago, underlining the scale of the problem.

Croissant shifting ecommerce from consumption to ownership

Items sold through a Croissant-integrated checkout can be sold back for money towards another purchase, similar to a part-exchange, instead of being discarded or wasting away at the back of a wardrobe. Croissant then deals with the tedious resale process, unlike second-hand apps which require the user to process the sale themselves.

“Croissant transforms the shopping mindset from one of credit-fuelled consumption to one of asset ownership, amplifying purchasing power and providing real financial empowerment for users,” the company says in a statement.

Investment in this early-stage round comes from Third Prime, BoxGroup, 25madison, and Twelve Below – as well as the previously named lead investors.

“Over the past decade, we’ve seen immense changes happen at e-commerce point of sale,” says Croissant CEO and Co-Founder John Howard. “Rapidly evolving consumer behaviour and expectations mean it’s no longer enough for merchants to have a seamless credit card or mobile wallet experience; they need to activate consumer psychology around the purchase decision in empowering, impactful and effortless ways to truly stand out.

“Croissant allows merchants to increase sales, consumers to buy more and better, and both to enjoy the benefits of resale without doing any reselling whatsoever.”

All the benefits of resale interest without the hassle

Stephanie Choo, Partner at Portage, continues: “Only a small percentage of resellable fashion is transacted globally each year, but it's still a US$130bn market that is rapidly growing.

“To date, retailers are seeing little to no benefit from this ongoing boom. Croissant enables them to harness the interest in and growth of resale to drive new full-price sales with minimal integration and no need to transact within the secondhand ecosystem themselves.”

- Walmart Majority-Owned Fintech, One, Launches BNPL ServiceDigital Payments

- Exploring Fintech Zilch Following AWS Partner ExpansionDigital Payments

- Nexway: Digital Monetisation for Global Business ExpansionFinancial Services (FinServ)

- Africa Fintech: Standard Bank launches Growth Plan for FloatDigital Payments