KPMG: Proptech, ESG investment up amid fintech funding dip

One of the world’s ‘big four’ consulting firms, KPMG, has released its Pulse of Fintech report covering H2 2023, in which it details investment trends in what was a challenging year (2023) for many fintech startups seeking to generate capital.

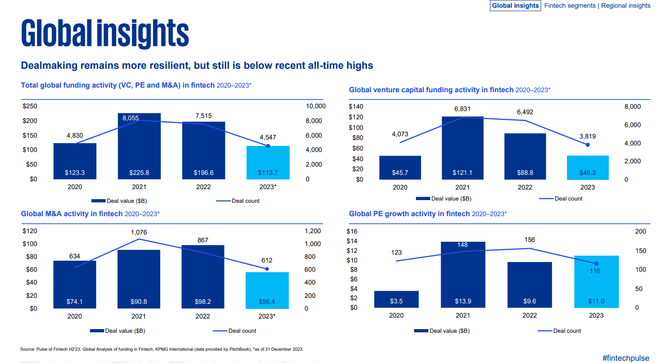

Total fintech investment of US$113.7bn and total funding deal counts of 4,547 represented the lowest year-total investment rates in this burgeoning industry since 2017.

The year-on-year decline in fintech investment for FY 2023 happened across all key regions of the investment landscape – with ASPAC experiencing the largest drop – from US$51.3bn in 2022 to just US$10.8bn in 2023.

In the same period, EMEA saw investment drop from US$49.6bn to US$24.5bn. It was in the Americas where there was the most resistance, with the investment drop just (comparatively) down from US$95.4bn in 2022 to US$78.3bn in 2023.

Proptech, ESG: Shining lights in the fintech investment landscape

And yet, amid this downturn in investment, proptech investment reached a record high of US$13.4bn in 2023, while ESG-focused fintech investment rose from US$1.2bn to US$2.3bn year-over-year.

This is significant in that it highlights the reach of fintech capabilities – an investment flurry in proptech initiatives reflects a growing understanding of the financial efficiencies and conveniences new tech in the real estate industry can give rise to.

And, a focus on ESG-led technology in fintech reaffirms the growing refocus of financial services providers to hit sustainability goals. Indeed, large banks like HSBC have recently ramped up their social commitments by restating their pledge to hit net zero by 2050.

What's more, insurtech investment saw investment grow year-on-year from 2022 to 2023 also, rising from US$5.9bn to US$8.1bn.

And, from a purely technological perspective, AI remained a clear leader by attracting over US$12.1bn in fintech investment despite a 2023 drop.

Overall, payments technology continued to dominate the majority of fintech investment across all key markets, despite dropping from US$57.9bn to US$20.7bn between 2022 and 2023.

Anton Ruddenklau, Global Head of Fintech and Innovation, Financial Services at KPMG International, says: “The fintech market floundered somewhat in 2023, buffeted by many of the same issues challenging the broader investment climate. While there were still good deals to be had, investors were definitely sharpening their pencils—enhancing their focus on profitability.

“While it was a depressed year for the fintech market overall, there were a few particularly bright lights. Proptech, ESG fintech and investors embraced AI-focused fintechs—which helped particularly in the last six months.”

So, looking to the future and the rest of 2024 where fintech investment is expected to remain soft (despite a bounce back), for KPMG, fintech companies must consider how they can drive the most value from their operational activities to stay well-positioned for sustainability in the long-term.

**************

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024.

**************

FinTech Magazine is a BizClik brand.

- Trulioo & Nium Partner for Compliant Payment ExperiencesFraud & ID Verification

- NatWest Enhances Global FX Payments in StoneX PartnershipBanking

- Bitcoin Halving Event: How Will it Affect the Crypto Market?Crypto

- Fintech 10x Banking and Deloitte Sign US, UK AllianceFinancial Services (FinServ)