How Mollie is Making Money Management Effortless in Europe

Since its launch exactly 20 years ago, Mollie has been on a brave expansion journey across Europe, making payments and money management a straightforward task for countless businesses across the continent.

The latest step in that journey has been to roll out Mollie Capital in the UK, giving SME merchants a fast and flexible way to access funding.

Already, the programme has provided loans totalling tens of millions of euros to thousands of small and medium-sized enterprises across Europe.

Helping businesses get paid

Founded in 2004, Mollie’s ultimate mission is to make payments and money management effortless for every business in Europe.

As one of the region’s fastest-growing financial services providers, the organisation is building a single platform for businesses to get paid and manage their money.

Payments, reconciliation, reporting, fraud prevention and financing are just some of the engagements being made simple for those already benefitting from the technology, which range from fledgling startups to large enterprises.

Members of Mollie’s 750-strong team are based all over Europe, including in Amsterdam, London, Lisbon, Milan, Munich and Paris, while more than 200,000 firms are using the platform to drive revenue, reduce costs and manage funds.

Mollie Capital driving growth

One of the major string’s to Mollie’s bow is Mollie Capital, which gives retailers the opportunity to bypass traditional lenders and access up to €/£250‚000 to help drive growth.

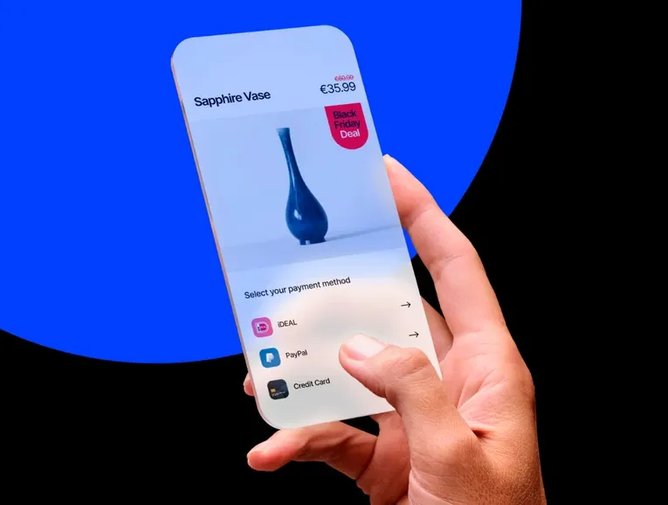

Since 2022, when the service was rolled out in mainland Europe, SMEs have used Mollie Capital to take advantage of deals to acquire cut-price inventory and boost marketing spend during peak shopping periods.

To date, Mollie Capital, which is offered in conjunction with YouLend, has provided loans exceeding €50m to more than 5,000 SMEs in the Netherlands, Belgium and Germany. Applications for funding tend to be highest during peak shopping periods, such as Black Friday and during the festive season.

Unlike traditional lenders, once a merchant has been processing payments with Mollie for 90 days, they are immediately eligible to apply for funding. Once a decision has been made, funds are transferred within 24 hours.

“We used Mollie Capital while renovating our new head office and warehouse,” explains Sebastian Bakker, General Director of the Dutch e-commerce brand, CookingLife, an early customer.

“It helped us pre-finance more activities during construction to invest more in our new warehouse. This will benefit us later during the year-end rush.”

Widespread demand for fast financing

The success of Mollie Capital in Europe underscores the latent demand from SMEs for fast financing and wider money management services.

This includes new businesses, companies requiring smaller funding amounts and those that prefer revenue-based financing.

As a result, Mollie Capital has just been expanded to cover the UK, where SME merchants are traditionally underserved by lenders. When they do apply, these firms must produce reams of financial data, endure lengthy application processes and wait weeks for a decision and the funds that follow.

Mollie itself was initially launched in the UK in early 2021, licensed via the Temporary Permissions Regime for EU-based financial services firms. Mollie was granted a Payment Institution licence by the UK's Financial Conduct Authority last year.

“Mollie Capital is our first financial service to launch in the UK – the first of many designed to eliminate financial bureaucracy for SMEs,” adds Mia Hunter, Managing Director at Mollie UK.

“For too long, small and mid-sized UK merchants have been neglected by incumbent payment services providers, lenders and banks. They just don’t invest in the simplicity and flexibility SMEs need to manage their finances.

“Mollie Capital fills a critical gap in the UK market. In Europe, we have customers repeatedly using—and paying back—this new source of funding to drive impressive levels of sustainable growth.”

******

Check out the latest edition of FinTech Magazine and sign up to our global conference series – FinTech LIVE 2024.

******

FinTech Magazine is a BizClik brand.