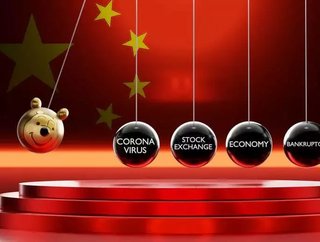

Coronavirus: impact on bitcoin price and possible recession

Bitcoin has hit a three-week low and fears of a global recession are rising as a result of the continued spread of coronavirus

Fears over the prospect of a coronavirus pandemic are impacting the financial services sector and hampering global economic growth.

Today it was reported that stock prices had slumped due to investors' panic over the continued spread of the virus, which has infected more than 82,000 people and killed more than 2,800.

As of this morning, it was reported that European equities had slumped - the FTSE 100 was down by 1.9%, the Euro SYoxx 50 down by 2.3% and Germany's DAX down by 2.3%.

Concerns around coronavirus are also reportedly behind fluctuating Bitcoin prices, too. As of the morning of 27 February, Bitcoin was down 10.08% for the week, sinking below $8,700, representing a drop of nearly $2,000 in two weeks.

Discussing Bitcoin's market fluctuation, CEO and co-founder of crypto social trading platform HedgeTrade, David Walsen, said that "during the first weeks of the coronavirus, Bitcoin acted as the uncorrelated asset that it has often been during economic and political upheaval, showing strong growth."

However, he explained, the last few days "took their toll on crypto's most important digital asset".

Global recession

This week, investors have warned that coronavirus could push the world to the brink of a global recession. It was reported by Bloomberg that former Federal Reserve Chair, Janet Yellen, Told the assembled audience at a Brookings Institution event in Michigan that "we could see a significant impact on Europe, which has been weak to start with, and it's just conceivable that it could throw the United States into a recession."

Similarly, Nigel Greene, founder and CEO of deVere Group, has warned that investors must take action sooner rather than later to build strength and safeguard their wealth.

Greene said that "coronavirus has struck at a time when major economies, including Japan, Germany, India and Hong Kong are are already facing a serious downturn." He added that "investors have largely been caught off guard by the serious and far-reaching economic consequence of the coronavirus.

"Clearly, this will hit global supply chains, economies across the world and ultimately government coffers too. Until such time as governments pump liquidity into the markets and coronavirus cases peak, markets will be jittery, triggering sell-offs."

SEE MORE:

- Klarna & Lady Gaga: get what you love

- Venmo reportedly testing teen debit card

- Mastercard confirms Michael Miebach as new Chief Executive

- Read the latest edition of FinTech Magazine, here

For more information on all topics for FinTech, please take a look at the latest edition of FinTech magazine.