How Spendesk is Setting the Standard in Financial Management

French fintech Spendesk is truly carving its own path in the field of spend management.

The startup, which reached unicorn status in 2022 having achieved a valuation of more than US$1m, has quickly become a leading platform, offering unparalleled efficiency and security to businesses across the globe.

Further evidence of Spendesk’s growth comes in the form of its latest integration with more than 40 HR platforms, including major players in the human resources space like PayFit, Personio, HiBob and Deel.

It’s an expansion that sets a new standard when it comes to seamless financial and employee management, as the firm’s VP for Europe, Stéphane Baranzelli, attests.

“This integration elevates the financial and employee management capabilities we offer our clients to an entirely new dimension,” he says.

“After thorough testing in beta phase with platforms such as Personio, as well as during its recent introduction to the market, the feedback has been exceptional.

“Users have praised its efficiency in streamlining operations and the substantial time savings it provides in managing user licences and onboarding processes.”

The ‘complete spend management platform’

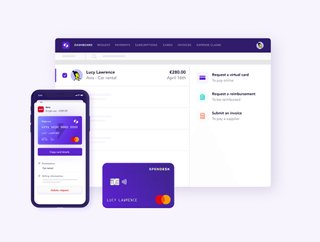

Founded in 2016, Spendesk is billed as the complete spend management platform, saving businesses time and money by connecting company spend.

With the integration of everyday technologies, built-in automation and an easily adopted approval process, the firm’s single solution is making agile, efficient spending easy for employees, while giving finance leaders complete visibility across entire company spend.

In 2022, Spendesk revealed it had raised an extension to its Series C funding round in the form of a US$114m investment from Tiger Global, resulting in the company’s valuation surpassing the US$1bn mark.

Eight years into its growth journey, Spendesk is trusted by thousands of businesses, from startups to established brands, and has offices in Paris, London, Berlin and Madrid.

What’s more, Spendesk-backed CFO Connect is the fastest-growing global community of finance leaders, with more than 10,000 members.

Streamlining user management

With its latest integration, Spendesk streamlines user management by enabling users to be synchronised automatically from the HR platform.

As a result, implementation and familiarisation with the expense management solution is much faster and user data consistency is guaranteed.

Headline features are as follows:

- Rapid onboarding: Easily connect HR tools with Spendesk to securely onboard all employees in minutes, with the flexibility to choose who is added

- Automatic user onboarding: New employees added to the linked HR tool will automatically be imported into Spendesk, complete with essential information

- Effortless off-boarding: Automatically archive employees who leave the company, removing access and ensuring an up-to-date user base while maintaining spend history

- Continuous synchronisation: Keep employee data in sync with any changes in the HR tool automatically reflected in Spendesk

- Advanced user management: Customise which employees are managed through a flexible user filter, with visual indicators for active, manually managed and out-of-sync members

“Our integration with Spendesk represents an important leap forward in financial efficiency for businesses and the financial wellbeing of employees,” comments Thomas Jeanjean, Chief Operating Officer at PayFit.

“Not only does this collaboration mean time savings for our companies, but gives employees transparency to what happens with your expenses and how it shows on your payslip.”

******

Check out the latest edition of FinTech Magazine and sign up to our global conference series – FinTech LIVE 2024.

******

FinTech Magazine is a BizClik brand.

- Mastercard: Powering the Digital Economy With Smarter TechFinancial Services (FinServ)

- Vodacom: Leading Fintech Growth & Supporting SMEs in AfricaSustainability

- Strategy Shift: Stripe De-Couples Payments From Tech StackDigital Payments

- Exploring Fintech Zilch Following AWS Partner ExpansionDigital Payments